- Exhibitors: Over 250 Chinese manufacturers and suppliers across diverse sectors such as manufacturing, electronics, textiles, construction materials, home appliances, and technology.

- Attendees: More than 5,000 Nigerian business representatives, entrepreneurs, and investors.

- Activities: Product exhibitions (Huawei, ZTE), trade matchmaking sessions, business seminars, and networking opportunities.

Business News

China-Nigeria 2025 Expo to Deepen Trade Ties

Nigeria and China are set to boost trade ties through the 2025 edition of the China Commodities Expo-Nigeria.

Over 250 Chinese manufacturers and more than 5,000 business representatives are expected to participate.

Brightway International Exhibition is organizing the expo with the Trade Development Bureau of the Chinese Ministry of Commerce.

The 2025 China Commodities Expo-Nigeria will take place from November 5 to 7.

The Chinese Consulate in Lagos and various Nigerian government agencies will also support the expo.

Amid rising global trade disruptions, China and Nigeria are deepening their bilateral trade ties.

Since its inception in 2007, the China-Nigeria expo has showcased various Chinese products and technologies. Thus, the 2025 expo will help facilitate economic and trade ties between China and Nigeria.

| Year | Date | Location | Key Features | Notable Participants/Highlights |

| 2024 | Nov 5-8 | Landmark Centre, Lagos | Agricultural technology, machinery, and innovation | Shandong Zhenghe International Exhibition |

| 2023 | Nov 7–10 | Landmark Centre, Lagos | 200+ Chinese exhibitors, sectors like agri-equipment, electronics, finance | Zedvance Finance, major suppliers from Shandong, Zhejiang, Fujian |

| 2019 | Nov 6–9, | Tafawa Balewa Square, Lagos | Focus on industrial equipment, palm oil processing tech | Henan Doing Machinery showcased palm oil equipment |

| 2018 | Nov 6–9, | Tafawa Balewa Square, Lagos | 1,600+ companies from around the world, emphasis on Sino-African cooperation | Chinese manufacturers from textile, machinery, electronics sectors |

What to Expect from the 2025 China Commodities Expo-Nigeria

Fast Fact: China-Nigeria Trade

- Total Trade (2023): $21.8 billion

- China’s exports to Nigeria: $20.18 billion

- Nigeria’s exports to China: $1.61 billion

- China’s Main Exports: Machinery, electronics, textiles, construction materials, and consumer goods.

- Nigeria’s Main Exports to China: Crude oil, liquefied natural gas (LNG), agricultural products (sesame seeds, cocoa, cashew nuts), and solid minerals.

China’s Investments in Nigeria

The 2025 expo was announced during the 2024 Forum on China-Africa Cooperation (FOCAC) Summit. The Forum on China-Africa Cooperation (FOCAC) is a major multilateral platform for diplomatic and economic cooperation between China and all 54 African countries. The forum allows Nigeria and China to discuss trade, investment, infrastructure, and development partnerships.

China is Africa’s largest trading partner ($282 billion in 2023). Key Chinese imports from Africa include crude oil, minerals, and agricultural products. Major Chinese exports to Africa include machinery, electronics, and consumer goods.

China has been increasing its investment in Nigeria in recent years. Over $1.5 billion has been invested in key projects such as the Lekki Free Trade Zone and the Ogun-Guangdong Free Trade Zone.

Lekki Free Trade Zone (LFTZ) is a special economic zone established by China in the Lekki Peninsula, near Lagos. Its key industrial focus includes manufacturing, logistics, oil and gas, trade, and services. As such, the economic zone is home to the Lekki Deep Sea Port, Dangote Refinery, and Lekki Airport (under construction). The Ogun-Guangdong Free Trade Zone (OGFTZ) is a China-Nigeria joint trade zone in Ogun State to boost manufacturing and export processing.

| Feature | Lekki Free Trade Zone (LFTZ) | Ogun-Guangdong Free Trade Zone (OGFTZ) |

| Location | Lekki, Lagos | Igbesa, Ogun State |

| Key Industries | Oil & gas, heavy manufacturing, logistics, petrochemicals | Light manufacturing, textiles, ceramics, agro processing |

| Infrastructure | Deep-sea port, refinery, gas pipelines, better power | Industrial parks, relies more on roads |

| Access to Port | Direct access to Lekki Deep Sea Port | Relies on Lagos ports (Apapa/Tin Can) |

| Strengths | High-growth industrial hub, port-linked, large-scale projects | Lower costs, proximity to Lagos markets |

| Best For | Large industries, oil & gas, export-oriented manufacturing | Light industries, Chinese investors, cost-sensitive businesses |

Many Chinese companies now operate in sectors such as manufacturing, infrastructure, and logistics within Nigeria.

Business News

AfDB Cuts Africa’s 2025 Growth Forecast Amid Global Trade Tensions

Country-Specific Growth Highlights

Despite the global trade uncertainties, some African countries are expected to exhibit robust growth in 2025.

| Country | 2025 Growth Forecast (%) | Key Growth Drivers | Challenges |

| Senegal | 8.7 | Oil and gas production, Infrastructure projects | External trade uncertainty |

| Rwanda | 7.7 | Growth in services and industrial sectors, government reforms, investment in infrastructure, Digital transformation | Limited natural resources |

| Ethiopia | 7.5 | Industrial parks, infrastructure development, expansion of manufacturing sector | Political stability, regional conflicts, inflation risks |

| Niger | 6.6 | Oil & mining expansion (Uranium), agricultural modernization | Regional security concerns |

| Tanzania | 5.9 | Agriculture, Mining, tourism, infrastructure development | External debt levels |

| Kenya | 4.9 | Agriculture, technology sector growth | Fiscal pressures, political instability in neighboring countries |

| Ghana | 4.6 | Diversified economy (industry & service sector), expanding consumer market | Commodity price volatility, High debt level |

| Tanzania | 5.0 | Mining, tourism, infrastructure development | External debt levels |

| Egypt | 3.9 | North African economic leader; diverse industries, strong trade ties with the Middle East, Europe, and North Africa region | High debt level, external trade uncertainty, regional instability (Middle East & North Africa) |

| Morocco | 3.8 | Gateway to European and West African markets; stable political environment; strong banking and industrial sectors | External trade uncertainty, Tension with Algeria |

| Nigeria | 3.1 | Oil exports, domestic market | Trade tariffs, inflation, High Debt level, FX pressures, Currency devaluation |

| South Africa | 1.0 | Africa’s largest economy; most advanced economy in Africa; diverse industries | Electricity crisis, external trade uncertainty |

Growth Performance and Outlook by Region

Below is a regional breakdown of the 2025 growth forecasts and the underlying factors.

| Region | 2025 GDP Growth Forecast (%) | Key Drivers | Challenges |

| East Africa | 5.9% | Strong performances in countries like Rwanda, Uganda, Tanzania, Ethiopia, Djibouti; investments in energy infrastructure and Agriculture | Ongoing conflicts in Sudan and South Sudan |

| West Africa | 4.3% | Full commencement of oil and gas production in Senegal and Niger); strong domestic demand; increased value addition in key agricultural products (Côte d’Ivoire, Gambia, Mali, and Togo) | Regional security concerns, global supply chain disruptions and increased volatility in financial markets |

| Central Africa | 3.2% | Commodity demand like metals and critical minerals. | Humanitarian crises in the Democratic Republic of Congo and declining oil & gas production and exports in Equatorial Guinea |

| North Africa | 3.6% | Strong European demand (France, Italy, Spain) | Downward revisions for countries like Egypt and Libya due to economic uncertainties. |

| Southern Africa | 2.2% | Strong domestic demand and exports to key trading partners (China and the United States) | Tariff uncertainty negatively impacting South Africa, Lesotho, and Botswana |

Business News

Nigeria to Review Its Trade Strategies Amid US Tariff Threat

Business News

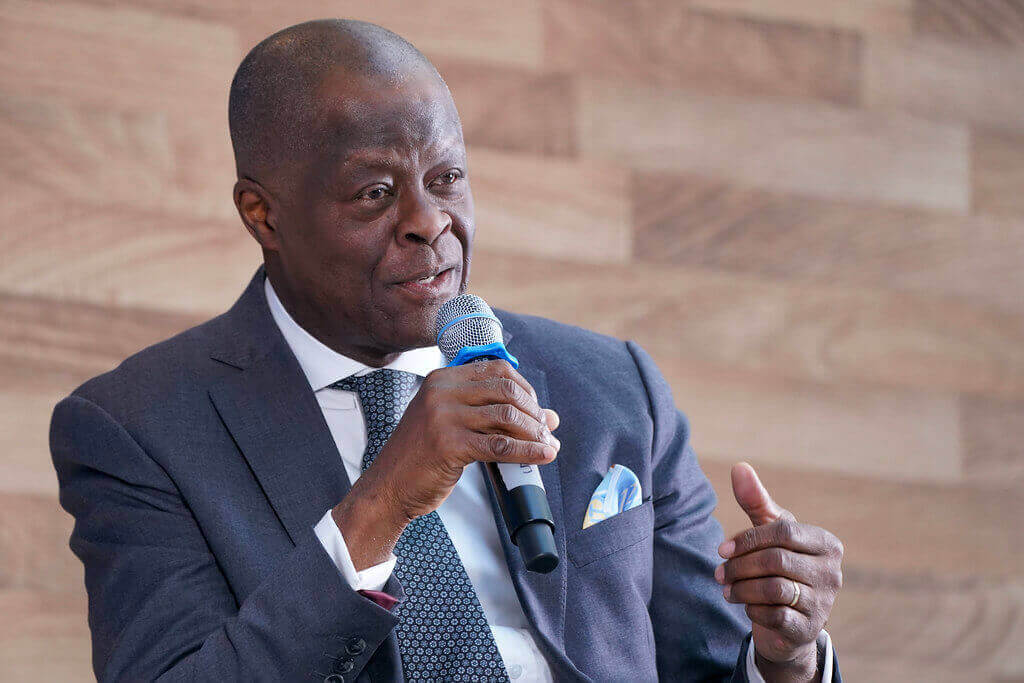

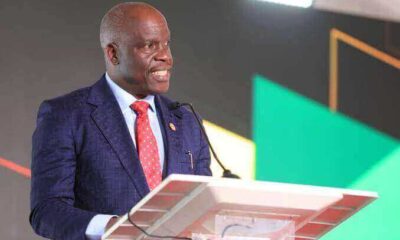

President Tinubu Swears In New NNPC Board

President Bola Tinubu, on May 22, inaugurated the newly appointed board and executive management of the Nigerian National Petroleum Company Limited (NNPC). The swearing-in ceremony occurred at the Aso Rock Villa in Abuja following their appointments on April 2.

President Tinubu inaugurated Ahmadu Kida, the board’s Non-Executive Chairman, and Bashir Ojulari, the NNPCL Group Chief Executive Officer.

The newly constituted 11-member board includes representatives from Nigeria’s six geopolitical zones and officials from key federal ministries.

Key government representatives in attendance were Heineken Lokpobiri, Minister of State for Petroleum (Gas); Mohammed Idris, Minister of Information and National Orientation; and Wale Edun, Minister of Finance and Coordinating Minister of the Economy.

New Leadership at NNPC

Bashir Bayo Ojulari, appointed as the Group Chief Executive Officer (GCEO), will lead the new NNPC board. Mr Ojulari possesses over two decades of experience in the oil and gas industry. He served as the Managing Director of Shell Nigeria Exploration and Production Company (SNEPCo) from 2015 to 2021.

Before his appointment as NNPCL GCEO, he was the Executive Vice-President and Chief Operating Officer at Renaissance African Energy Company. Renaissance Africa is a consortium of five companies that bought Shell’s onshore assets in Nigeria for $2.4 billion.

Before being appointed the Non-Executive Chairman of the board, Ahmadu Musa Kida was a seasoned executive with a background in the oil industry. In 1985, he joined Total Exploration & Production Nigeria, where he worked for over 30 years. He ascended to prominent roles, including the Deputy Managing Director of the Deepwater District in Lagos in 2015. His expertise led him to serve as an Independent Non-Executive Director at various oil and gas companies, including TotalEnergies Nigeria.

Composition of the 11-Member Board Appointed by President Tinubu

Apart from Bashir Bayo Ojulari and Ahmadu Musa Kida, the other nine (9) board members include:

- Adedapo Segun: NNPCL’s Chief Financial Officer

- Bello Rabi: Represents the North West.

- Yusuf Usman: Represent the North East.

- Babs Omotowa: Represents the North Central. He was the former Managing Director of Nigeria Liquefied Natural Gas (NLNG)

- Austin Avuru: Co-founder and former CEO of Seplat Petroleum Development Company. He represents the South-South.

- David Ige: Represents the South-West.

- Henry Obih: Represents the South-East.

- Lydia Shehu Jafiya: Permanent Secretary of the Federal Ministry of Finance. She represents the Ministry of Finance on the board.

- Aminu Said Ahmed: Represents the Ministry of Petroleum Resources on the board.

Former NNPC Board Members

- Chief Pius Akinyelure: Non-Executive Board Chairman

- Mallam Mele Kolo Kyari: Group Chief Executive Officer

- Alhaji Umar Isa Ajiya: Chief Financial Officer

- Ledum Mitee: Non-Executive Director

- Musa Tumsa: Non-Executive Director

- Ghali Muhammad: Non-Executive Director

- Prof. Mustapha Aliyu: Non-Executive Director

- David Ogbodo: Non-Executive Director

- Eunice Thomas: Non-Executive Director

- Okokon Ekanem Udo: Permanent Secretary, Federal Ministry of Finance

- Gabriel Aduda: Permanent Secretary, Federal Ministry of Petroleum Resources

NNPC’s Strategic Mandate and Expectations

President Tinubu outlined key ambitious targets for the new board to accomplish by 2030 during the inauguration ceremony.

The plan is to boost crude oil production to over 2 million barrels per day by 2027 and 3 million barrels per day by 2030.

To reduce its reliance on imported petroleum products, NNPC plans to expand its domestic refining capacity to 200,000 bpd by 2027 and to 500,000 bpd by 2030.

On the gas front, the aim is to boost gas production to 10 billion cubic feet (BCF) per day by 2027 and 12 BCF per day by 2030.

In terms of pipelines, Ojulari would advance gas infrastructure projects. These include the OB-3 and AKK gas pipelines to boost domestic gas usage. He is also expected to advocate for regional gas pipeline projects, such as the Nigeria-Morocco Gas Pipeline, to enhance Nigeria’s gas export capacity.

Future Outlook

President Tinubu inaugurated the new NNPC board after he dissolved the previous board, which was headed by Mele Kyari (former GCEO) and Pius Akinyelure (Non-Executive Chairman).

Former President, Muhammadu Buhari, appointed Melee Kyari as the GCEO in June 2019. Although Mr Kyari oversaw the company’s transition into a limited liability entity in 2022, his tenure was marred by declining oil production amid rampant crude theft and pipeline vandalism.

Therefore, the new NNPC board is expected to spearhead critical objectives. One key objective is to attract $30 billion in investments by 2027 and $60 billion by 2030.

In addition, the new board will perform a “strategic portfolio review” of NNPC’s operated and non-operated assets. The planned reviews come as NNPC prepares for a planned initial public offering within 12–15 months.

Another key objective of the new NNPC board is to complete all gas infrastructure projects. Key gas pipeline projects include the Ajaokuta–Kaduna–Kano (AKK) Gas Pipeline, the Nigeria–Morocco Gas Pipeline, the Nigeria LNG Train 7 Expansion, the OB3 Pipeline, the Brass Methanol and Gas Hub Project, the UTM Offshore Floating LNG Project, and others.

Business News

Dangote Refinery Agrees to Export Polypropylene with Vinmar

Polypropylene is a type of plastic polymer used in various applications. These include packaging, automotive parts, textiles, construction materials, and medical devices. It is known for its durability, chemical resistance, and lightweight properties.

The statement coincides with the recent launch of Dangote’s $2 billion petrochemical plant in Ibeju-Lekki, Lagos. The plant is designed to produce 77 grades of polypropylene using UK firm INEOS Innovene technology.

With an annual capacity of 900,000 metric tons, the plant began producing polypropylene in March.

Established in 1978, Vinmar is a global leader in the marketing and distribution of petrochemicals, serving customers in more than 110 countries. By cooperating with Vinmar, Dangote gains access to a robust global supply chain and technology in polymer exports.

Overview of the Dangote-Vinmar Partnership

Dangote-Vinmar’s partnership follows the commissioning of Dangote’s $2 billion petrochemical plant in the Lekki Free Zone in Lagos.

The plant began producing polypropylene in 25kg bags for the local market in March.

With an annual production capacity of 900,000 metric tons, the facility features two units capable of producing 500,000 mt/year and 330,000 mt/year, respectively.

Polypropylene Production and its Economic Impact

Polypropylene is a thermoplastic polymer made from propylene monomers.

In packaging, polypropylene is essential for plastic containers, food packaging films, bottle caps, and films.

The textile industry uses polypropylene for carpets, ropes, upholstery, and reusable shopping bags.

Due to its lightweight and strong properties, the automotive sector utilizes the product in bumpers, dashboards, and battery casings.

Due to its sterility and durability, polypropylene is used in healthcare for syringes and medical vials.

The construction and electronics industries utilize polypropylene for insulation materials, cables, and battery cases.

Polypropylene’s versatility and benefits make it a popular choice for packaging across many industries.

Nigeria Polypropylene Market Overview

According to Trademap, Nigeria’s annual polypropylene import hit $370 million in 2024, $267.7 million in 2023 and $407 million in 2022.

Nigeria imports 90% of its annual polypropylene requirements, amounting to 250,000 metric tons annually.

With an annual capacity of 830,000 tons, Dangote plants will export about 600,000 tons to global markets. At the same time, it is dedicating 250,00 MT to meet domestic demand.

Thus, Dangote’s strategic partnership with Vinmar will enable it to meet local demand and become a net exporter.

Apart from production, Dangote’s partnership with Vinmar will involve marketing polypropylene in 25 kg bags. Platts last assessed the CFR West Africa PP raffia spot price at $1,090/mt on March 5, unchanged from the previous week.

With an annual capacity of 830,000 tons, Dangote plans to export about 600,000 tons of the product mainly to other African countries and the United States.

Previously, Nigeria depended on imports from the Middle East and domestic production from Indorama Petrochemical plant.

Saudi Arabia, South Africa, South Korea, China, and Vietnam are among the top importers of polypropylene into Nigeria.

Africa’s Polypropylene Market

By 2035, Africa’s market volume will reach 5.5 million metric tons, with a market value of $7.7 billion.

Consumption

In 2024, polypropylene consumption hit 4.7 million tons. The value of polypropylene in the primary forms market in Africa totaled $6.3 billion. Egypt (1.1M tons) and South Africa (742K tons) had the highest consumption volumes.

In value terms, the largest polypropylene markets in primary forms in Africa include Egypt ($1.5 Billion) and South Africa ($993 million).

Production

Polypropylene production in primary forms dropped to 3.6 million tons in 2024, representing a value of $4.6 billion.

The countries with the highest volumes of production in 2024 were South Africa (911K tons), Egypt (908K tons), and Somalia (367K tons).

Imports

In 2024, Africa imported 1.6 million tons of polypropylene, valued at $2.3 billion.

Egypt was the leading importer of polypropylene into Africa, with a volume of imports of 434K tons. Nigeria (183K tons) ranks second in terms of total imports.

In value terms, the largest polypropylene importers were Egypt ($622 million), Nigeria ($370 million) and Algeria ($194 million).

Import Prices By Country

In 2024, the average import price into Africa amounted to $1,426 per ton. Nigeria had the highest price ($2,025 per ton), while Uganda had the lowest ($1,177 per ton).

Exports

In 2024, global shipments reached 493K tons, valued at $690 million. Egypt (270K tons) and South Africa (206K tons) represented roughly 97% of total exports, valued at $382 million and $289 million, respectively.

Export Prices By Country

The export price from Africa stood at $1,397 per ton in 2024. Egypt ($1,414 per ton) was the country with the highest price, while South Africa stood second at $1,402 per ton.

-

Business News5 months ago

Business News5 months agoNigeria’s Oil and Gas Reserves 2025 Reach 37 billion barrels & 210.5 TCF

-

Analysis & Opinions5 months ago

Analysis & Opinions5 months agoTop Oil Producing States in Nigeria

-

Gas4 months ago

Gas4 months agoNLNG Enters a Gas Supply Deal with Seplat Energy

-

Analysis & Opinions5 months ago

Analysis & Opinions5 months agoComplete List of All Refineries Operating in the UK

-

Oil5 months ago

Oil5 months agoCrude Oil Prices May 5, 2025: Brent & WTI Rates

-

Oil5 months ago

Oil5 months agoSaudi Aramco Increases June Oil Prices For Asia Amid OPEC+ Supply Hike