Nigeria’s oil and gas reserves in 2025 have hit a record high of 37.28 billion barrels and 210.5 trillion cubic feet.

This figure compares to the 37.50 billion barrels of proven crude oil reserves and 209.26 TCF of proven natural gas reserves recorded in 2024.

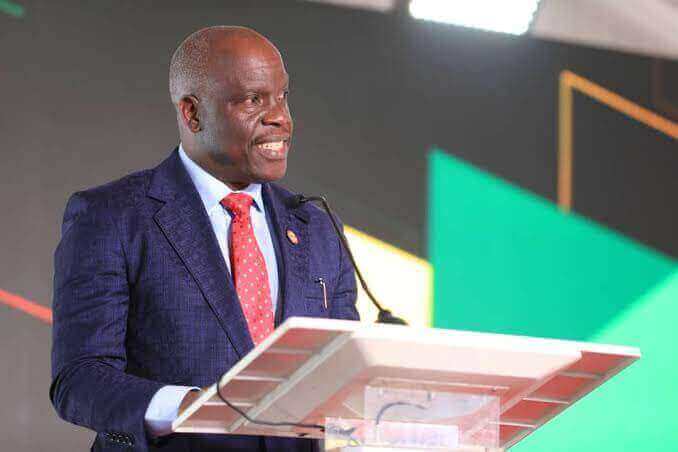

Gbenga Komolafe, Chief Executive Officer of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), declared the data on April 11.

With the new data, Nigeria retained its position as Africa’s second-largest crude reserve holder, behind Libya. However, Nigeria remains Africa’s biggest oil producer.

According to the Commission, releasing the 2025 oil and gas reserve figures complied with the relevant sections of the Petroleum Industry Act (PIA) 2021.

The NUPRC puts the Reserves Life Index for Nigerian oil at 64 years while that of gas is 93 years.

Globally, Nigeria ranks about 11th in proven crude oil reserves and 9th in proven gas reserves.

Despite this strong reserve base, Nigeria’s global production share is somewhat lower than its reserve ranking—primarily due to underinvestment, infrastructure issues, security concerns, and regulatory uncertainties.

Oil Reserves Hit 37 Billion Barrels

According to NUPRC, Nigeria’s proven (2P) crude oil and condensate reserves stand at 31.44 billion barrels and 5.84 billion barrels, respectively, for a total of 37.28 billion barrels.

In April 2024, crude oil and condensate were recorded at 31.56 billion barrels and 5.94 billion barrels, respectively, for a total of 37.50 billion barrels.

For clarity, 2P reserves, or proven reserves, are a classification of oil and gas reserves that represent the best estimate of recoverable resources in a particular location.

Gas Reserves Hit 210.5 TCF

In the gas sector, associated gas reserves are pegged at 101.03 TCF, while non-associated gas reserves hit 109.51 TCF — collectively they sum up to a jaw-dropping 210.54 TCF.

In 2024, the reserves of Associated Gas and Non-Associated Gas stood at 102.59 TCF and 106.67 TCF, respectively, to hit 209.26 TCF at the time.

Thus, Nigeria retains its position as Africa’s largest proven gas reserve holder and about ninth globally.

Oil & Gas Reserves: Comparative Analysis with Other Energy Rich Countries

| Country |

Oil Reserves (Billion Barrels) |

Gas Reserves (tcf) |

Key Strengths |

| Nigeria |

37.28 |

210.54 |

Largest African oil producer, high gas potential |

| Libya |

48 |

53 |

Largest African reserves, but political instability is impacting upstream activities |

| Angola |

2.6 |

4.6 |

Deepwater expertise, declining output |

| Algeria |

12.2 |

159.1 |

Strong gas exports to Europe |

| Saudi Arabia |

267 |

336 |

World’s top exporter, low production costs |

Nigeria Oil & Gas Sector

Nigeria’s oil and gas sector accounts for over 50% of government revenue and over 80% of its foreign exchange earnings.

In addition, the sector typically contributes between 6% to 9% of Nigeria’s total GDP.

Crude oil production declined to a five-month low of 1.4 million barrels per day in March 2025 during the period under consideration.

In November 2024, Nigeria produced 1.48 million bpd, 1.48 million bpd in December, 1.53 million bpd in January, and 1.46 million bpd in February, before the latest figure of 1.4 million bpd recorded in March.

According to data released by the NUPRC, the production figure represented 93% of the Organisation of Petroleum Exporting Countries (OPEC) quota of 1.5 million bpd, down from 98% in February.

Despite its potential, the sector faces challenges such as:

- Oil Theft and Pipeline Vandalism

- Nigeria loses ~400,000 barrels per day (bpd) to theft and sabotage.

- The Trans-Niger & Trans Forcados Pipeline are frequently targeted for vandalism

- Regulatory Changes: The Petroleum Industry Act (PIA 2021) is still in the implementation phase.

President Bola Tinubu recently pledged to increase Nigeria’s crude oil production from under 1.5 million barrels per day to over 2 million per day by 2027 and 3 million barrels by 2030. Regarding gas, the aim is to grow gas output from the current 8.5 bcf per day to 10 bcf per day by 2027 and 12 billion by 2030.

To boost oil production, the upstream regulator launched the Project 1 Million Barrels of Oil Per Day (1MMBOPD) initiative in October 2024. The initiative aims to increase Nigeria’s crude oil production by an additional one million barrels per day in 24 months.

To achieve this, NUPRC held bid rounds in 2024, which would allow increased oil production. After a competitive bidding process, 25 winners emerged from NUPRC’s 2024 bid round.

To boost gas Monetization and domestic utilization, the government is implementing its Decade of Gas Initiative (2021-2030). This ambition seeks to expand gas usage in the power and industry sectors.

Key projects include the NLNG Train 7 Project, which will increase LNG capacity by 35%. The Ajaokuta-Kaduna-Kano (AKK) Gas Pipeline is another project that entails transporting gas from southern to northern Nigeria. Others include the Brass Fertilizer and Petrochemical Plant and the Obiafu–Obrikom–Oben (OB3) Pipeline.